The mission of Captiva is to partner with your business to make purchasing benefits for your employees more affordable — and to make those benefits more effective for everyone involved. That means an approach that forgoes the status quo, using new business models and new methods in order to provide a benefit process that is the best case scenario for everyone involved.

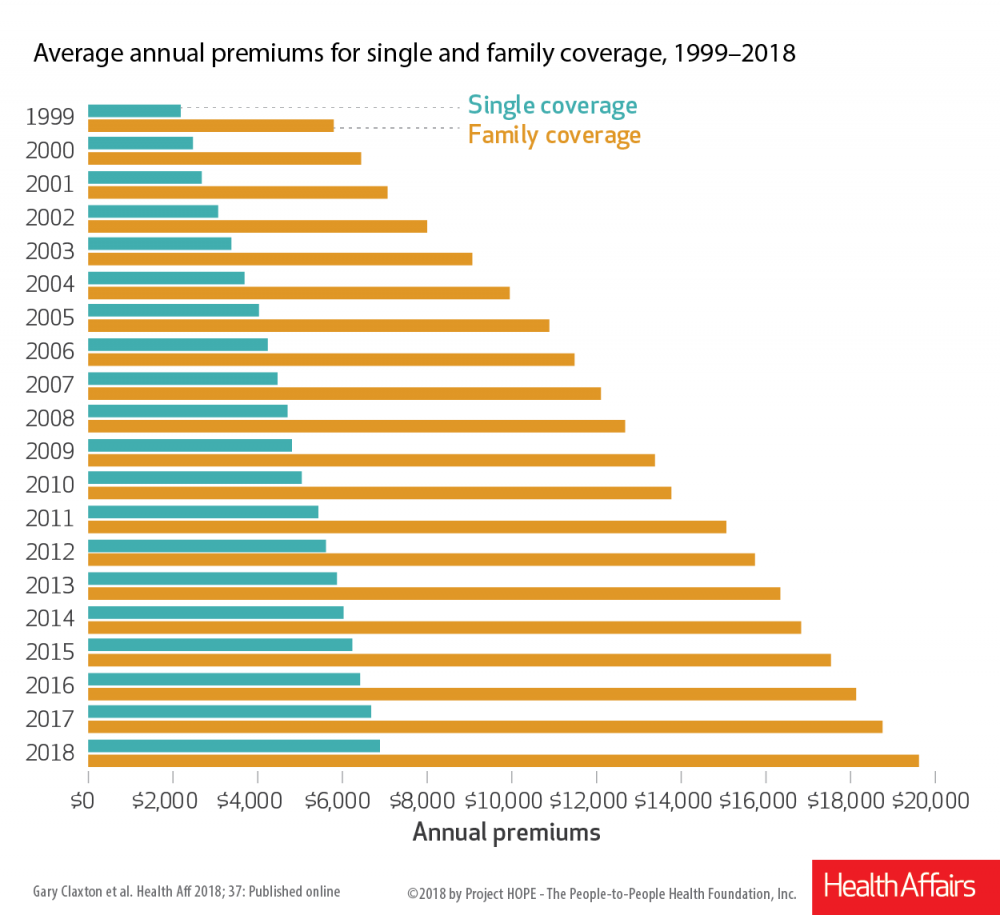

With the costs of healthcare perpetually on the rise, there might be a temptation to forgo offering health benefits to employees at all. Unfortunately, many smaller businesses take that route.

However, that choice can cause real and lasting damage to both your employees’ satisfaction-- and your ability to hire employees to begin with.

According to a poll taken last year by Glassdoor, one of the leading job search services in the United States, benefits rank only barely below salary on the list of job seekers’ priorities. And a crucial part of any benefits package is the healthcare portion.

The reasoning isn’t hard to understand: no matter how good your salary is, a medical disaster can eat it up in a matter of days if you’re uninsured or underinsured. As a result, a lot of career advice is centered around the question of balancing a salary offer and a benefits package when choosing from a list of potential job offers.

Once you’ve attracted quality applicants to your business and hired them, ideally you’ll want to keep them there. Employee retention is a crucial part of any company strategy, as having employees stick around for longer often means that profits stay consistently higher. Having personnel continuity lends itself to more employee satisfaction and a smoother workflow.

According to a 2018 survey, the quality of the healthcare benefits are a significant factor in why more than half of employees stay at a given job. Their overall satisfaction was driven by the type of coverage, cost and how much control of options they had. But the number one reason for dissatisfaction? Cost.

Even if your employees don’t actually leave the company, the anxiety, stress and dissatisfaction of having inadequate healthcare is likely to impact workplace morale, which in turn reduces productivity.

Employees who do not feel like they are able to get health issues cared for before they progress to something extreme may ultimately find themselves facing costly bills and crises that make them unable to come into work for days or weeks at a time.

It’s clear that the cost of not having affordable, adequate healthcare benefits offered to your employees is real — both for the overall health of your company, and for every individual who is a part of it.

At Captiva, we can help you connect your benefit needs to solutions that will keep costs down and deliver effective care to your employees.

If you’re ready to get started implementing a system that will allow you to offer more for less spend, attract more skilled employees and keep them longer and confidently navigate a chaotic healthcare landscape, give us a call!

How Much Do Employees Value Healthcare? is courtesy of: www.captivabenefitsolutions.com