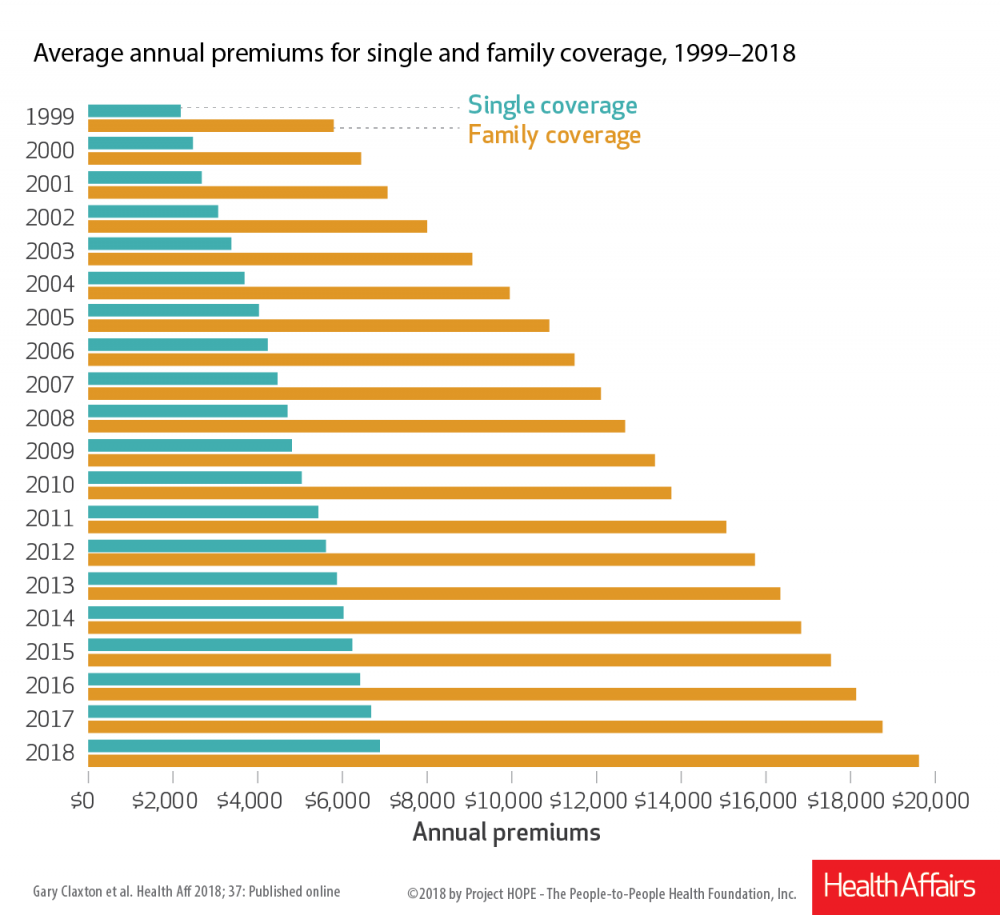

As health insurance costs continue to rise, employers are struggling to stop the expenses from overburdening their employees.

A recent study by Aon found that throughout the course of 2018, healthcare premiums have overall risen by 3.5%. However, most employees only experienced a 2.2% rise, as employers have chosen to absorb some of the increase themselves.

This means that employers were paying 3.9% higher premiums in 2018. That's a big pill to swallow as companies are trying to make a profit and stay afloat.

This information has several important things to tell us.

First of all, it tells us what we already know: health costs, including premiums, are continuing to make up a disproportionately high percentage of expenditures. The increase rate is three times the rate of general inflation.

And unfortunately, initial analyses suggest that 2019 might see an even higher price increase.

But Aon reports tell us about more than just bare facts about the statistical rise of premium costs. It also tells us that employers are taking an active role in trying to triage the situation so that their employees aren’t saddled with the extra costs.

A lot of that active negotiation of costs has involved experimenting with non-traditional methods of providing healthcare benefits. Even with premiums increasing, alternate options are increasing also.

This is where Captiva Benefit Solutions comes in. We believe there is a better way than just paying the increasingly rising premiums that insurance providers demand.

Utilizing elements of the Health Rosetta like transparent open networks and advisor relationships, we can help your business stay ahead of the premium increase curve.

The Aon data that proves that more employers are trying to negotiate better options for their employees is proof that Captiva is on the cutting edge of combating premium hikes.

Our model joins companies like Walmart, Boeing, Cisco and Intel in opting to enable the employer to negotiate directly with healthcare providers. That approach cuts back on overhead, provides more personalized care and removes unnecessary costs so that premium increases are removed from the equation entirely.

Getting out of the way of snowballing premium increases is just one of the ways in which Captiva can help your company provide more affordable, more streamlined, more effective benefit options to your employees. If you’re ready to take the next step towards better benefits, contact us to get started.

Employers Fight to Absorb Higher Healthcare Premiums is courtesy of: Captiva Benefit Solutions

No comments:

Post a Comment